The headlines have been telling us over and over again that the U.S. stock market is achieving record highs, and the not-so-subtle implication is that they have nowhere to go but down. In fact, the “lost decade” of 2000 to 2010 has obscured the fact that, historically, it is pretty common for stocks to achieve record highs.

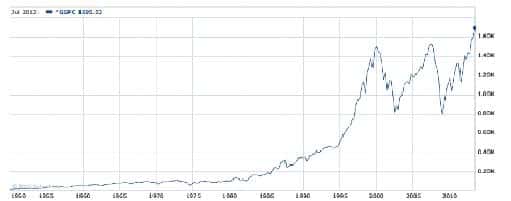

If you look closely at the accompanying chart, you’ll see that since 1950, the overall trend, until 2000, was a smooth if somewhat boring upward climb from 21.40 in January of 1950 to 55.34 in January of 1960 (more than a 150% gain), to 89.63 in January of 1970, to 102.09 in January 1980, to 339.94 in January of 1990. Record highs were recorded on a routine basis, and the trend accelerated from 1990 to 2000. That’s roughly 50 years where the news media would have found nothing remarkable about stocks traveling into uncharted territory.

The pullback associated with the “tech wreck” decline in 2000 and the 2008 market meltdown have turned a relatively smooth ride into the kind of rollercoaster that carries warnings for people with back problems and heart conditions. Never mind that the markets are up 9,706.42% since 1950; the headlines today tell us that we’re back above the market tops of 2000 and 2007.

History suggests that the steady, moderate growth of the 50 years ending in early 2000 is more normal than what we experienced during the first decade of the 21st century, when we endured two major collapses, the first brought on by rampant speculation in dotcom ventures (and Wall Street’s phony and ultimately punished “research”), the other by Wall Street’s reckless speculation on packaged mortgages. The ride may never become as smooth as it was in the past century, and it’s certainly possible that the returns won’t be quite as generous. We have never known for sure. But it’s possible that four or five years from now – or 50 or 60 – all the incremental market tops will elicit barely a yawn from investors, and won’t command headlines in our newspapers. Do you think it makes sense to prepare by ignoring them today? Let’s give it a try.